The Renault-Nissan-Mitsubishi Alliance has had a rocky past few years in the form of slumping sales and quality of their vehicles, as well as the controversial departure of former chairman and CEO Carlos Ghosn. Now, the three manufacturers have announced the approval of its new plan to restructure the alliance 24 years after its inception.

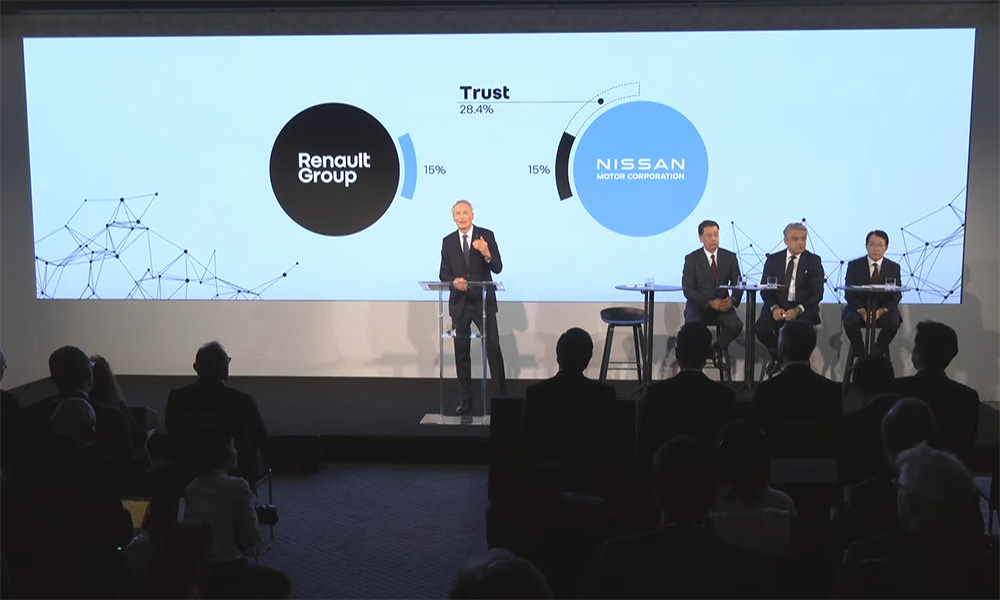

One of the significant highlights to come out of the conference is Renault Group’s lowered stake in Nissan Motor Corporation from 43.4% to 15%, saving the remaining 28.4% in a French trust fund acting as neutral grounds for both companies. This hopefully aims to bring balance on both the Japanese and French sides in corporate decision-making and influences.

Also mentioned was its push for new models in Latin America, India and Europe, adding to existing road map brought up in the Alliance 2030 project. With continuing models and new rebadges on the horizon, the overall goal is to provide electrification for all regions in the form of subcompact and compact vehicles with the CMF-AEV (Common Module Family) platform for developing countries, and the CMF-BEV platform for the EU.

Continuing from its electrified future, Nissan in return would invest 15% in Renault’s new EV sub-brand Ampere. Both Nissan and Mitsubishi would also be customers of the Horse project, a collaboration with Renault and Geely that aims to supply sustainable ICE and hybrid powertrains and transmissions for their respective groups’ models.

After Ghosn was booted from his powerful role in the alliance, the new chairman Jean-Dominique Senard hopes that the rebalancing of the three companies will bring “new opportunities, not because they are forced to do so, but just because it’s good for them.”

0 Comments